Objective

We aim to generate absolute returns and to outperform global equity markets over the medium term (3-5 years) by investing in companies that create value from innovative products, services and business models that address key challenges facing businesses, consumers and societies, where the impact of such innovation is not fully priced in by the market

These include traditional areas of innovation such as technology, communication, healthcare and industrials as well as other sectors associated with new business and societal challenges that create incremental demand for innovation such as renewable energy, electrification of vehicles, sustainable materials and affordable healthcare for under-served markets.

Key Information as at 29 March 2024

| Launch Date: | May 2022 |

| Fund Size: | £8.1m |

| IA Sector: | Global |

| Benchmark: | MSCI ACWI |

| Number of holdings: | 39 |

| Investment Team: | Mikhail Zverev Graeme Bencke Gareth Blades |

| ISAable fund: | Yes |

| Minimum lump sum investment | £1000 |

| Regular savings: | £50/mth |

| Initial charge: | 0% |

| Ongoing charges: | Capped at 1% (incl annual management charge of 0.75% and research charge of 0.10%) |

| Share type: | B Accumulation |

| ISIN: | GB00BKVF3N76 |

| Scheme type: | A sub-fund of a UCITS Open Ended Investment Company that is structured as an umbrella company |

Amati Global Innovation Fund

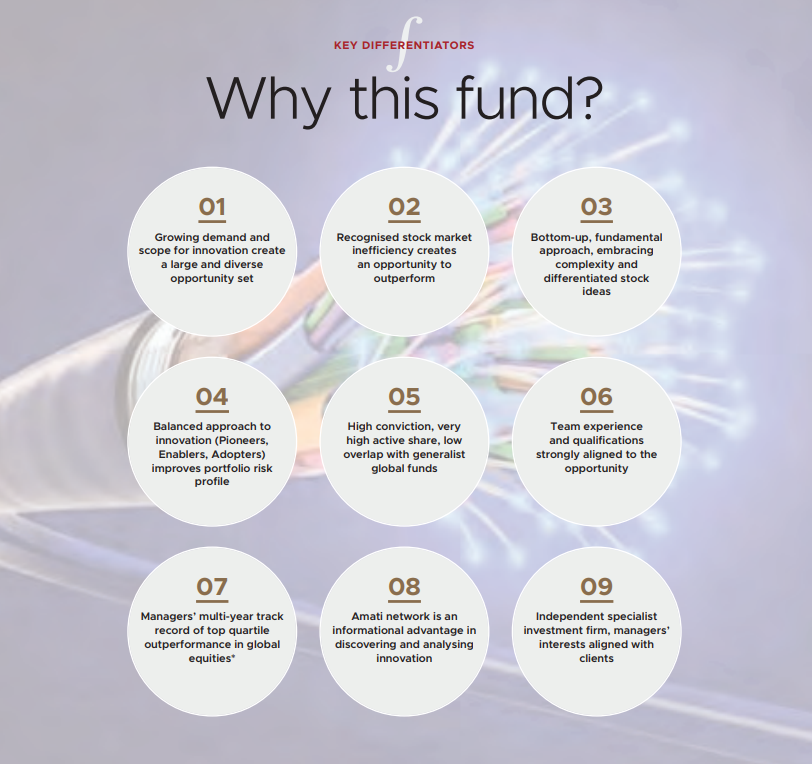

The Fund is a high conviction, concentrated global equity portfolio comprising of companies that create innovative products, services and business models to address key economic, consumer and societal challenges.

The Opportunity

We see innovation as an ever-green opportunity and academic research backs that. The Fund aims to generate alpha by taking advantage of market inefficiency and our team have the investment experience and academic credentials to understand the change, complexity, uncertainty, and market behavioural biases perpetuating this multi-decade outperformance opportunity.

The Fund’s Ethos

We select investments from a broader innovation opportunity set; businesses that are Pioneers: “creating innovation”, Enablers: “supporting innovation” and Adopters: “implementing innovation”. From these innovation clusters, we identify the opportunities with optimal upside asymmetry, providing a better portfolio risk profile, especially relevant since the era of lower for longer interest rate combined with geopolitical stability may be over.

Why now?

At this point we see greater diversity of opportunities to develop and apply innovation, the “perimeter” of innovation is expanding in many sectors such as life sciences, semiconductors, and others.

We believe that now is the time to broaden out the pursuit of innovation away from a few ubiquitous mega-caps and away from focus on high growth / low profitability stocks which have proven a lot more vulnerable than many expected.

Some pockets of stock market – high growth innovators, often lacking profitability and cash generation, experienced spectacular growth in the past several years and have seen a lot of that performance reversed in the recent sell-off. A supportive environment of lower-for-longer interest rates and near unlimited access to capital which such innovative companies enjoyed recently may not persist going forward. This calls for a different approach – accessing a broader opportunity set, being more mindful of profitability, returns and cash generation metrics and valuation discipline.

What does this fund add to a client portfolio?

If you are underinvested in global funds – this global fund is a highly active, differentiated strategy, targeting distinct market inefficiency and source of alpha which the team at Amati are well positioned to capture.

If you have allocated to global funds – this fund is likely to add incremental opportunities from specialist, complex areas which general purpose global funds tend not to capture well.

If you have allocated to funds investing in innovation – this fund is likely to diversify your exposure away from increasingly volatile high growth/low profitability end of the market, and away from widely held mega-cap technology stocks.

Risk Warning

Past performance is not a reliable guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount they originally invested. The return on investments in overseas markets may increase or decrease as a result of exchange rate movements. There may be occasions where there is an increased risk that a position in the Fund cannot be liquidated in a timely manner at a reasonable price. In extreme circumstances this may affect the ability of the Fund to meet redemption requests upon demand. Prospective investors should always read the Key Investor Information Document and the Prospectus, which contain full details of the costs and charges applicable to the Fund as well as specific risk warnings.

Our perspective on investing in Innovation

“Embrace complexity but don’t limit yourself to moon-shots”

Innovation is an opportunity for global equity investors

There are countless examples of businesses applying innovation and generating wealth in their existing industries and even creating entirely new markets.

As technology advances, the pace of innovation and its adoption is accelerating, changing the way entire industries operate. In our highly connected world these changes are not limited to single markets or geographies but rapidly spread, often creating enormous value.

While this fact is well understood it has rarely been systematically exploited by investors and It is our belief that focusing directly on this process presents an exciting opportunity for global equity investors.

Our investment experience and a growing body of academic research suggests that the stock market is not efficient in pricing in the impact of innovation on companies and their ecosystems. We aim to benefit from this inefficiency.

Innovation brings about change, uncertainty and complexity and creates impact across sectors – investors are often biased against these factors in their investment approach and are not always optimally equipped and organised to identify, assess, and therefore price that impact.

Academic research and empirical evidence demonstrate that it represents an area of significant market inefficiency. Researchers observe that the stock market “consistently misvalues innovation” and “appears to under-react to the information contained in R&D investments”, that it is possible to “pick winners and losers solely based on public information”, creating an opportunity for active stock pickers*.

What’s more, the academic work explicitly links this market inefficiency to fundamental investor behavioural biases, specifically citing aversion to uncertainty and complexity, and analytical and attention span constraints*. Since these behavioural traits are consistently observed over most time periods this suggests that the inefficiency opportunity is likely to persist for an extended period of time. It is our belief that by focusing directly on the impact of innovation on companies and their ecosystems, by embracing the analytical complexity, there is a clear outperformance opportunity.

Investors should look at broader range of innovation stocks, not only high growth / high risk segment of the market

Investing in “leading lights” of innovation, often fast-growing companies that do not yet generate cash flows or profits, often “concept stocks”, has been very rewarding in the past 10 years, despite the sharp sell-off in the past 12 months.

However, if we examine the underlying drivers, we can see that this performance was not just driven by fundamental progress in those innovative companies. A significant proportion came from increased investor risk and growth appetites, which was in turn linked to interest rate expectations.

Because high growth, low profitability companies have most of their projected cash flows far into the future, the low interest rate environment made these stocks more valuable, often beyond the fundamental merit of their underlying businesses. Momentum and bullish investor sentiment further amplified these gains.

Stock market participants often referred to these as “long duration” assets, comparing high growth, low profit stocks to a “duration trade”, or bet on “lower-for-longer” interest rates. This is starkly illustrated by examining the outperformance of growth stocks (represented by S&P 500 growth sector against broader S&P 500 index) in comparison to interest rate expectations (represented by US 10-year treasury yield). Plotted against each other these reveal how much of the historic outperformance was explained by interest rates and sentiment.

Chart below shows how correlated growth stocks outperformance had been with interest rate expectations:

Source: Bloomberg

Risk here is not just stock volatility and style rotation. We have seen a rapid reversal of growth stocks over the past 12 months, but many would argue that it is just a matter of time horizon until long term fundamentals shine through. However, another risk factor is the fundamental viability of these high growth / low profit companies.Such companies often do not generate enough cash flow to sustain their growth, instead relying on open and generous capital markets for repeated funding.

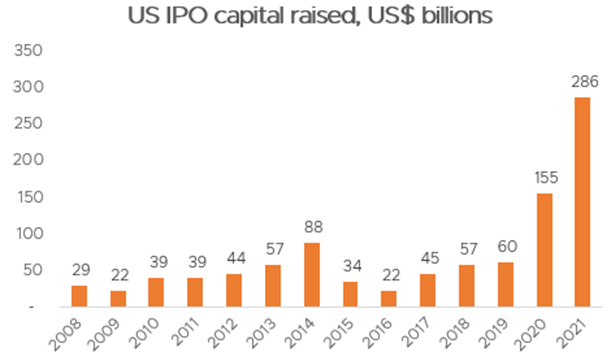

Near-free capital available to such companies in recent years enabled a lot more of such funding than has been the long-term trend.

Source: NASDAQ

As one illustration of this, the last several years have seen record amounts of IPO funding, more recently even in the shape of SPACs (which have easier disclosure terms and enabled companies to be more promotional in telling their stories). This enabled and sustained the funding of concepts and ideas that would have been much harder to finance in a more normalised market environment.

The coming decade is likely to be characterised by higher macro and geopolitical uncertainty, higher inflation and higher interest rate expectations. The consequent increase in the cost of capital will mean that the flood of money that has supported these high growth / low profit companies will provide less buoyancy going forward.

This does not negate the point that investing in innovation is a valuable source of outperformance opportunity. However, we believe it will be essential for investors to take a broader look at where innovation is mis-priced and to back not only “moon shots” but also more established, higher quality businesses in order to capture more optimal asymmetry of returns and provide a better balance of risk in their portfolios.

This broader approach to investing in innovation should not come at the expense of avoiding complexity. As the academic evidence suggests, complexity of innovation and its impact is the origin of the market inefficiency and therefore of the outperformance opportunity.

A well-known investment adage “do not invest in things you don’t understand” is often interpreted as a reason for avoiding complexity. However, our view is different – we believe investors should be selectively embracing complexity in order to understand it and develop non-consensus insights.

We see that some of the biggest structural changes in business and society demand innovative and often highly complex and technical solutions.

The transition of business and consumer activity into digital space demand specialist software and hardware tools for increasingly niche industry verticals.

Electrification of more areas of human activity, from vehicles to industrial applications to residential heating, again demands tailored solutions and specialist supply chains.

Decarbonisation and energy transition drives innovation in areas of material science and industrial equipment which are both specialist and complex in nature. Not to mention the rapidly expanding perimeter of scientific discovery and innovation in life sciences and healthcare.

Investors should pursue these areas in a holistic way, across regions, sectors, and value chains. In our view it is particularly beneficial to straddle different market segments – private companies, smaller companies as well as the larger listed companies – in researching this innovation and change.

Often companies at the earlier stage of their journey are closer to the innovation frontier in their industries, and conversations with their executives or founder-entrepreneurs can be particularly insightful.

But sometimes the best place to apply those insights is somewhere else in the value chain, maybe in a stock with lower business risk and more optimal upside / downside trade-off that will generate returns in a more normalised macroeconomic environment.

This approach is integral to the Amati investment process, and we are looking forward to applying this informational and analytical advantage for the benefit of our clients in the global equity asset class.

* Lauren Cohen, Karl Diether, Christopher Malloy; The Review of Financial Studies, 2013. Tristan Fitzgerald , Benjamin Balsmeier , Lee Fleming , Gustavo Manso ; Management Science, 2020. David Hirshleifer, Po-Hsuan Hsu, Dongmei Li; The Review of Financial Studies, 2018. Kewei Hou, Po-Hsuan Hsu, Shiheng Wang, Akiko Watanabe, Yan Xu, Journal of Financial and Quantitative Analysis (JFQA), Forthcoming

Risk Warning

Past performance is not a reliable guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount they originally invested. The return on investments in overseas markets may increase or decrease as a result of exchange rate movements. There may be occasions where there is an increased risk that a position in the Fund cannot be liquidated in a timely manner at a reasonable price. In extreme circumstances this may affect the ability of the Fund to meet redemption requests upon demand. Prospective investors should always read the Key Investor Information Document and the Prospectus, which contain full details of the costs and charges applicable to the Fund as well as specific risk warnings.

Portfolio

WS Amati Global Innovation Fund

As at 29 March 2024

Top 10 Holdings

| 10 Largest Holdings | % of total assets |

| PTC Inc | 4.0% |

| Iqvia Holdings | 3.9% |

| Novonesis | 3.9% |

| Danaher | 3.8% |

| SK Hynix | 3.7% |

| Eli Lilly | 3.1% |

| Prysmian Spa | 3.0% |

| Qiagen | 3.0% |

| Laboratory Corp | 3.0% |

| Booz Allen Hamilton | 2.9% |

Performance

WS Amati Global Innovation Fund

B Class

Performance

Cumulative Performance Table

as at 29/03/2024

| Time period | Fund Return (%) | Benchmark Return** (%) |

|---|---|---|

| 1 month | 3.76 | 3.22 |

| 3 months | 9.45 | 9.13 |

| 6 months | 20.99 | 16.01 |

| 1 year | 22.02 | 20.54 |

| Since launch* | 24.45 | 27.42 |

* Since launch data is calculated from 15/03/2021.

** MSCI ACWI Index (GBP), Total Return. Past performance is not a guide to future performance.

WS Amati Global Innovation Fund – Annual & Interim Reports

Ratings

How to Invest

WS Amati Global Innovation Fund is administered by Waystone Management (UK) Limited. Before investing you should view the relevant documents below.

For telephone dealing and enquiries please call:

Waystone Management (UK) Limited

Client Services and Dealing Line

T: +44 (0)345 922 0044

E: investorservices@linkgroup.co.uk

Application Form

For further information regarding the application form, please visit Waystone’s website here.

Platforms

Aegon Institutional, Aviva, AJ Bell, Embark, Fidelity, Fundment, Funds Network, Hargreaves Lansdown, Hubwise, Interactive Investor, Nucleus, Pershing, Raymond James, Standard Life Wrap, Transact

FAQS

Please find below answers to some of the most frequently asked questions for WS Amati Global Innovation Fund. Should you wish to discuss another query, please contact us on 0131 503 9115 or email info@amatiglobal.com.

If you wish to apply for shares directly, please download the relevant form from the How to Invest Section above.

The WS Amati Global Innovation Fund is available on the majority of platforms. If your chosen platform does not currently hold the fund, please contact the relevant platform manager and ask that they contact us on 0131 503 9115 or email us on: info@amatiglobal.com

Daily at Midday.

T+4.

The minimum lump sum investment is £1,000.

The minimum lump sum top up is £500.

The minimum regular monthly investment is £50 per month.

As the WS Amati Investment Funds are intended for investors seeking long-term capital growth, all income arising within them is reinvested into the value of shares. In other words the shares are all accumulation shares. The annual income allocation date is 31 March and the interim income allocation date is 30 September.

MSCI ACWI Index (GBP) Total Return.