WS Amati Strategic Metals Fund

Investing in a broad range of base metals, the active, high conviction WS Amati Strategic Metals Fund creates a fresh and exciting opportunity for those looking to diversify their portfolios and invest in the transition to clean, sustainable energy sources and a lower carbon world. The Fund seeks to deliver long-term capital growth by investing in a well-diversified portfolio of internationally listed metals and mining companies – listed in London, US, Canada and Australia, and whose primary revenues are derived from ‘strategic metals’, metals with a limited substitution threat and which Amati deems to be of strategic importance to the global economy and numerous long-term structural growth themes. These include, but are not limited to gold, silver, copper, lithium, nickel, manganese, platinum group and rare earth metals.

The Managers – Dual Expertise

The fund is managed by Georges Lequime and Mark Smith who boast decades of experience investing in mining companies and many years of operational experience in mining and geology. The pair combine strong technical and industry knowledge with proven financial modelling and portfolio management skills. Georges Lequime, a mining engineer with 26 years’ experience in fund management and investment banking, spent four years in gold mining in South Africa. Mark Smith meanwhile has 18 years’ experience in investment banking and company valuations and spent five years in West and East Africa in gold exploration – and it is the global network of CEOs and CFOs, brokers, commodity traders, mining engineers and geologists they have built which is responsible for so many of the opportunities they unearth.

Why Metals, Why Now?

The extraordinary level of quantitative easing seen in recent times has given investors good reason to hold gold, but policy will change – so, whilst the managers remain positive on precious metals, the demand for specialist metals will continue to grow as we transition to a lower carbon world and move away from fossil fuels. Energy distribution power grid infrastructure is dependent on copper, just as energy storage for industrial use and battery technology is on lithium and electrification is on both nickel and copper – and the managers see exciting investment opportunities in these areas.

Through the Cycle Investing

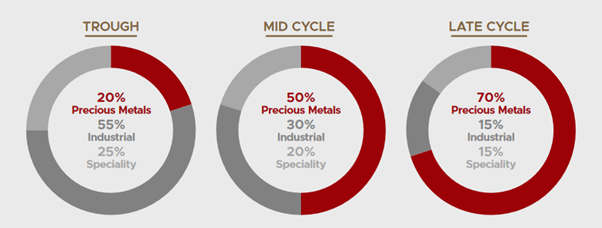

Each metal has its own cycle. The managers aim to provide actively managed exposure ‘through the cycle’ and will look to determine the optimum combination of precious, speciality and base metals at any given time, in keeping with the transition to clean energy, electric vehicles and other long-term structural growth themes – taking account of the over-arching macro-economic and political risks and commodity price movements, as well as the specific circumstances of individual companies.

Why invest?

WS Amati Strategic Metals Fund

Click here to view our fund brochure.

This fund offers investors exposure to precious, speciality and industrial metals within a single actively managed fund.

Investment Opportunities

Despite widespread recognition that global decarbonisation presents a major challenge, many people still significantly underestimate the enormity of that challenge and the critical role that metals play in tackling it.

An acceleration in electrification and migration from fossil fuels to clean, sustainable energy sources requires such an abundance of key metals that it raises important questions on whether decarbonisation is even remotely feasible. It also warrants fresh consideration of future metals supply and demand.

We include precious metals (gold and silver) in our definition of strategic metals as they are integral to the global monetary system and can be used as a hedge (means of protecting against potential loss) in the event of a disruption to the financial system.

Why Metals, Why Now?

A broad basket of metals is integral to every aspect of modern life, from consumer electronic devices to domestic appliances, manufacturing, construction, energy generation and storage and transportation.

We have highlighted eight critical factors we believe will have greatest impact on demand. They include: mining exploration and development, trends in economics, geo-politics and technology, and decarbonisation efforts.

Reaching a Supply/ Demand Pinch Point

In the case of many metals, demand is expected to outstrip supply in the short-to-medium term. This is likely to keep prices well above levels needed to encourage the development of new mining projects and to fuel an exploration boom.

However, a commitment to capital expenditure is required to ensure that when markets reach a pinch point in metals supply, new production is ready to come on stream to replace depleted mines.

Hands on experience: Our managers have dual expertise in fund management and mining.

Fund managers Georges Lequime and Mark Smith possess an uncommon combination of technical mining and geological expertise as well as fund management expertise. They have combined experience of more than four decades of investing in international mining companies. Georges’ investment track record includes managing the highly successful and award-winning Earth Gold Fund since 2008. They are not only both fluent in financial modelling and portfolio management but also have years of operational experience in mining and geology.

Investing through metal cycles

We recognise a need for investing from one particular metal cycle to the next and seek for this to be a dynamic, long-term growth fund.

Our aim is to produce an investment vehicle that provides actively managed exposure to this dynamic segment of the equity market that investors can hold for the long term.

The diagram of the metal cycle illustrates how portfolio weightings might look at specific stages of the metal cycle. For example, it shows that allocation to precious metals can generally be expected to be at its lowest at the trough point in the metal cycle, increasing as the cycle progresses to a late stage.

Finding hidden gems

We focus on companies with strong technical teams as well as experience at the corporate level. Creating value ‘through the drill bit’ can be transformational for the value of a smaller company. The calibre of a company’s management and their ability to successfully execute a mining project from exploration to production phase are critical for de-risking a project. De-risking includes conducting extensive exploration work, arranging appropriate financing for different project stages, and lowering production costs.

ESG considerations

The mining industry is often referred to as a ‘dirty’ industry. However, this overlooks the fact that all companies are not alike in this respect and that within the industry there are good examples of companies that have set high standards in environmental, social and governance matters.

Forward-thinking, ethically-run and well-managed companies understand that an ability to build and maintain good relations with workers, host nations and local communities goes hand-in-hand with building a world-class mining company and achieving long-term value.

Important Information

Past Performance is not a reliable guide to future performance. The value of investments and income from them may go down as well as up and investors may not get back the amount they originally invested. The investments associated with this fund are concentrated in natural resources companies which are subject to greater risk and volatility than companies held in other funds with investments across a range of industries and sectors. Issued and approved by Amati Global Investors which is authorised and regulated by the Financial Conduct Authority. Registered address: 8 Coates Crescent, Edinburgh EH3 7AL

Overview

Objective

The Fund aims to achieve long term capital growth through investing in a well-diversified portfolio of internationally-listed metals and mining companies whose primary revenues are sourced from the sale of strategic metals. These metals, deemed to be of strategic importance to the global economy and future macro-economic trends include, but are not limited to, gold, silver, platinum group metals, copper, lithium, nickel, manganese, and rare earth metals. The fund is able to invest in mining companies listed in London, US, Canada and Australia.

Philosophy and Key Benefits

- Bottom up with macro-overlay: Rigorous stock-picking, combining analysis on macroeconomic and sectoral factors.

- Diversified: Curating a high conviction portfolio of 35-40 stocks.

- Through the cycle approach: Aiming for the optimum combination of precious, speciality and base metals.

- Benchmark agnostic: Flexibility to hold medium to smaller-sized mining companies that can meaningfully grow their value.

- Fundamental research: The team’s wealth of experience means that they have access to a global network of company CEOs and CFOs, brokers, commodity traders as well as mining engineers and geologists – an added advantage when performing their analysis.

- ESG considerations: Integral to each manager’s due diligence and research.

- Dual expertise: Strong technical & industry expertise combined with proven fund management experience.

- Risk management: Active monitoring with a focus on liquidity and diversification.

Key Information as at 30th June 2024

| Launch date: | March 2021 |

| Fund size: | £64.2m |

| IA sector: | Commodities & Natural Resources |

| Benchmark: | MSCI World Metals & Mining Index (GBP) |

| Number of holdings: | 41 |

| Investment Team: | Georges Lequime Mark Smith |

| ISAable fund: | Yes |

| Minimum lump sum investment: | £1,000 |

| Regular savings: | £50/mth |

| Initial charge: | 0% |

| Ongoing charges: | 1% (incl. annual management charge of 0.75% and research charge of 0.10%) |

| Share type: | Accumulation |

| ISIN | GB00BMD8NV62 |

| Scheme type: | A sub-fund of a UCITS Open Ended Investment Company that is structured as an umbrella company |

Portfolio Information

As at 30th June 2024

Top 10 Holdings

| 10 Largest Holdings | % of total assets |

| Pan American Silver Corp | 6.2% |

| Fresnillo | 5.7% |

| Reunion Gold | 4.5% |

| K92 Mining | 4.1% |

| Eldorado Gold | 4.0% |

| Atlantic Lithium | 4.0% |

| MAG Silver Corp | 3.9% |

| G2 Goldfields | 3.7% |

| I-80 Gold Corp | 3.4% |

| Liberty Gold | 3.2% |

Class Split (% of total assets)”]

Performance

B Class

*WS Amati Strategic Metals Fund, Total Return.

**MSCI World Metals and Mining Index (GBP), Total Return. The stocks comprising the index are aligned with the Fund’s objectives, and on that basis the index is considered an appropriate performance comparator for the Fund. Please note that the Fund is not constrained by or managed to the index. Sources: Waystone Management (UK) Limited, Financial Express Analytics and MSCI. Information in this factsheet is at the last valuation point of the month, except where indicated.

Cumulative Performance Table

as at 28/06/2024

| Time period | Fund Return (%) | Benchmark Return** (%) |

|---|---|---|

| 1 month | -9.65 | -4.78 |

| 3 months | 11.83 | 0.74 |

| 6 months | -3.92 | -1.4 |

| 1 year | -13.97 | 6.72 |

| Since launch* | -18.41 | 29.99 |

* Since launch data is calculated from 15/03/2021.

** MSCI World Metals and Mining Index (GBP), Total Return. Past performance is not a guide to future performance.

Statistical sources: all performance data as at 31 January 2024: Source – Waystone Management (UK) Limited and Financial Express Analytics. Further details: Issued by Amati Global Investors Ltd., authorised and regulated by the Financial Conduct Authority. Registered in Scotland, number: SC199908. Registered address: 8 Coates Crescent, Edinburgh, EH3 7AL.

How to Invest

WS Amati Strategic Metals Fund is administered by Waystone Management (UK) Limited. Before investing you should view the relevant documents below.

For telephone dealing and enquiries please call:

Waystone Management (UK) Limited

Client Services and Dealing Line

T: +44 (0)345 922 0044

E: wtas-investorservices@waystone.com

Application Form

For further information regarding the application form, please visit Waystone’s website here.

Key Information Documents – Strategic Metals Fund

Key Information Documents to read before investing

Should you wish to receive our monthly fund factsheets by email, please contact: info@amatiglobal.com or call 0131 503 9115

For further information please speak to your financial adviser.

WS Amati Strategic Metals Fund – Annual & Interim Reports

Ratings