Lithium Industry

Lithium Industry

‘…you want to invest in the companies who aim to be first to stand second in the queue’

Mark Smith

Co-manager, TB Amati Strategic Metals Fund

February 2022

Although it is noble to be the ‘barbwire man’, history only remembers the winners. In the lithium space you want to understand the complex chemistry and process engineering to invest in the winners, not the pioneers - select the companies who are second in the queue...

It is clear the energy transition will be metal intensive, and the supply-demand deficit projections vary widely. However, the common denominator will be a supply shortage unless the mining industry adapts and changes.

Exhibit 1 – Factors of global metal production to meet EV demand

- In the International Energy Agency’s EV30@30-scenario*, Europe is projected to need between 15% and 70% of the current global production of critical metals in 2030

- In its scenario in which all new cars sold in Europe in 2030 are electric, Europe will need as much as 1.5 times

- In the global EV30@30 scenario, up to three times the current annual global production will be needed to produce sufficient electric cars in 2030

*EV30=30% market penetration

Source: University of Netherlands

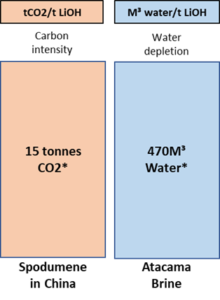

Global lithium production focuses on concentration from a primary source (evaporation in brines or spodumene concentration) and then refining and separation from gangue (brine refining or spodumene conversion). In both stages energy and reagents are consumed to concentrate and refine, and waste is generated – there is an ESG trade off, effectively between water consumption and hydrological disruption or an energy carbon footprint.

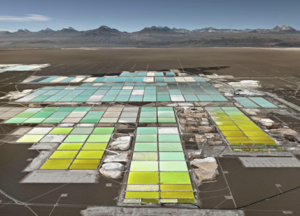

Lithium brines

Lithium brines are a very important part of the lithium supply equation, with estimates suggesting brines accounting for ~45% of global LCE supply in 2021, rising to 60% by 2030. Lithium brine deposits are typically characterised by large resource bases/ultra-long mine lives, production costs at the bottom of the global cost curve (i.e., higher margin), and superior sustainability credentials (i.e., significantly lower CO2 intensity based on solar evaporation concentration) compared to converted hard rock sources. However, the scarcity of water in the Latin American lithium triangle is becoming an environmental issue and the brine extraction and associated water loss is changing the hydrology and chemistry of the connected water basins under the salars.

Exhibit 2 – Sources of Lithium

Brine ponds Atacama Desert

Source: Company reports

In the case of lithium brine operations, ‘conventional’ solar evaporation-based processing is premised on the removal (precipitation) of impurities from brines through the application of reagents which combined with solar evaporation serves to concentrate lithium grades ahead of carbonation and purification. However, there are limitations to expansion of conventional resources, including increasing demand for energy, limitations on land use, waste disposal, water accessibility and use, and poor economics in developing lower-grade deposits. You need to invest in new extractive technologies….

Exhibit 3: The current environmnetal footprint of the lithium industry

Source: Minviro

Spodumene

Key to investing in the sector is to identify orebodies and associated companies that can support an integrated ‘mine-to-market’ business model. This enables the supply chain to shorten and become less fragmented.

- The orebody has to be high grade1 and of scale with low contaminants2

- The battery producer manages the chemical conversion

- Take or pay contracts established with prices linked to hydroxide pricing

- Select battery manufacturers with high credit ratings and project finance facilities

Exhibit 4: The lithium supply chain

1 Conventional DMS premium product >6% Li at a coarse crush with low fines. Low orebody grade variability.

2 Low contaminant<1% Fe2O3, <3% Combined Na2O/K2O

Source: Amati Global Investors; Industry reports

Direct Lithium Extraction – maybe a ‘solution’ to an environmental problem

DLE describes a group of technologies that removes lithium from a brine to produce a concentrated lithium solution. The two main processes are:

1. Adsorption – a physical electrostatic process where LiCl molecule in brine is absorbed onto sorbent and removed with a strip solution. Used for geothermal lower concentration brines and there is a trade-off between selectivity and brine concentrations. The concentration of impurities Mg; Na and Ca must be understood.

2. Ionic exchange – a chemical process where the Li+ in in the brine is absorbed into solid ion exchange material and swapped for other positive ions (acid).

DLE-based processes are typically suited to lithium brine deposits with lower lithium concentrations and/or higher impurity levels. DLE-based methods preferentially extract lithium with impurities remaining in the ‘spent’ brine and reinjected into the aquifer.

The advantages of DLE include – easy to understand!

• improved economics of exploiting lower grade/higher impurity lithium resources

• lower reagent consumption

• reduced fresh-water consumption

• significantly shorter production lead times (vs typical 12–18-month residence times in evaporation ponds)

• smaller physical footprint (i.e., no evaporation ponds, waste disposal).

Risks to DLE include – harder to appreciate!

• Longer development timelines (in its early stages) due to higher level of test work required given variability of brine chemistries.

• Companies must go from bench scale test work to pilot scale to commercial scale and produce consistent produce in sufficient quantity over a prolonged period.

• Typical scale up factors should be around 10,000x any less and the project could experience problems.

• Higher energy consumption (higher operating costs), a result of high volumes of brine extracted and reinjected

• Technical risks associated with the reinjection of brine, as the chemistry of the brine has changed which could cause preferential precipitation thus reducing the porosity of the aquifer.

• Understanding the lithium brine cut-off grades; DLE – 100ppb; Pond evaporation 300ppb.

The Amati Strategic Metals Fund has identified the companies in the queue.

At the time of writing the Amati Strategic Metals Fund has 42.9% portfolio weighting the in battery metals through its investments in specialty metal and base metal developers and producers. Our direct weighting in lithium stocks is 14.1%.

Exhibit 5 – Structure and cost of the battery

Source: BloombergNEF

In the above article we have highlighted how complex the lithium market is with the potential pitfalls identified. We caution ‘blindly’ investing in the potential DLE lithium companies who claim to have the holy grail of extractive technologies at commercial scale. We have spent a lot of time searching for companies who stack up from a geological, chemical, and technological standpoint. By proxy these are companies with a strong ESG framework. However, we have spread our investments across the spodumene and the DLE salar and geothermal brine companies to mitigate risk.

This article is a financial promotion issued by Amati Global Investors Limited, which is authorised and regulated by the Financial Conduct Authority. It is provided for informational purposes only and does not represent an offer or solicitation to buy or sell any securities. Nor does it provide you with all the facts that you need to make an informed decision about the merits or otherwise of this Fund. Please refer to the risk warning below.

Risk Warning

Past performance is not a reliable guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount they originally invested. The investments associated with this fund are concentrated in natural resources companies, which are subject to greater risk and volatility than companies held in other funds with investments across a range of industries and sectors. The return on investments in overseas markets may increase or decrease as a result of exchange rate movements. Shares in some of the underlying companies associated with the fund may be difficult to sell in a timely manner and at a reasonable price. In extreme circumstances this may affect the ability of the fund to meet redemption requests on demand.

Amati Global Investors Ltd, 8 Coates Crescent, Edinburgh EH3 7AL +44 (0)131 503 9115 info@amatiglobal.com www.amatiglobal.com

Amati Global Investors is authorised & regulated by the Financial Conduct Authority.

Calls are recorded and monitored.