Market Commentary – Metals Team, April 2022

By Mark Smith and Georges Lequime

The battle between bullion and US treasury yields continues, as the ‘fight’ to de-dollarize and create a new global reset continues. Chinese export growth weakened in April as lockdowns hit production.

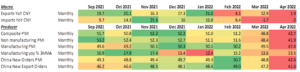

Chinese import and export data for April was released on the morning of 9 May. Export growth slowed to 1.9% yoy (from 12.9% in March) while imports continued to fall with yoy growth -2% (from -1.7%). The purchasing manager index (PMI) data remained in contraction with the composite PMI falling to 42.7 (from 48.8); the non-manufacturing PMI fell to 41.9 (from 48.4); and the manufacturing PMI fell to 47.4 (from 49.5). This, alongside weaker commentary about the housing market, has led to further concerns over Chinese growth and demand. This has weighed on the industrial metals complex.

Exhibit 1 – Chinese economic and industrial data

Source: Berenberg

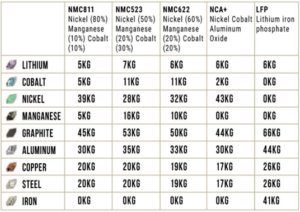

We have tried to avoid direct exposure to the industrial metals in the TB Amati Strategic Metals Fund, rather to focus on the battery specialty metals and high grade nickel stocks. However, as the sector has done so well over the last 12 months, we have witnessed profit taking in these stocks over the course of the last 4 weeks. Given that global EV sales more than doubled in 2021 and forecast to reach 15 million units by 2025, the demand for battery metals is fully charged. We will look to add to this sector on weakness.

Exhibit 2 – Metal content in a 60KWh battery (small 4 door hatch back)

Source: Elements

US policy makers continue to raise rates by 50bp increments rather than doing anything larger. So 50/50/50 hiking cycle is being increasingly solidified, but markets aren’t necessarily happy with that as they continue to indicate very disinflationary price action. A big reason for the recent pullback in risk assets (like stocks, crypto, and some economically sensitive commodities like copper), as well as in precious metals, has been fears that they will be taking interest rates into outright “restrictive” territory (i.e. well above the 2.5% neutral level). If the Fed can deliver such an aggressive, brute force attack on inflation, it may likely lead to collateral damage and consequences. But with 8.5% inflation, a little demand destruction will not be sufficient.

The only new position we added to the fund was a 2% weight in a graphite developer, poised to sign binding offtake agreement and release an optimised definitive feasibility study to produce coarse flake graphite. We sold our copper stock after taking profits from a block trade.