Market Commentary – Metals Team, July 2022

By Mark Smith and Georges Lequime

The summer of misinformation and misdirection. It is hard to know what to believe, no more so than in the commodity markets. The copper price lost one of its most influential cheerleaders, after Goldman Sachs chopped its near-term price forecasts in anticipation of a sharp slump in consumer spending and industrial activity as Europe’s energy crisis deepens. With the copper price 40% below Goldman’s projections, they threw the towel in and picked on another commodity, Lithium. With a published report full of errors (in our view) ‘The End of the beginning’ report cited ‘the lithium market will to pivot towards a prolonged phase of surplus starting this year’, and ‘long term prices to fall to $16,000/t’, as the current high prices will create demand erosion in the battery market.

This report coupled with a need for liquidity during a sharp market correction was enough for the weak hands of investors to sell the lithium equities. The ASMF added to our lithium positions and drew down cash to invest in this opportunity. As we have stated before, the lithium market is in a real structural supply deficit and the battery fabricators are price takers. There is an air of desperation within European automotive manufacturing with regard to battery metals and other critical materials. OEMs are offering up-front cash incentives for offtake from companies with critical metal projects, some of which are still desk top studies. This is where having a technical understanding of mining projects helps us navigate the potential pitfalls to this industry trend.

July saw a sharp commodities selloff, and the Fed tightened financial conditions at the quickest pace since 2008 and 2020, putting the wealth effect into reverse. Quantitative (belt) tightening has further reduced liquidity. This liquidity removal caused most asset classes to lose value, resulting in the "everything" bear market. Instead of asset class rotation (risk asset capital moving to safe havens), all classes were for sale. Related to liquidity draining, volatility of all asset classes (including currencies, bonds, equities and commodities) has soared. The precious metal miners fared badly in this thinly traded market retracing to their 10-year low range on valuation. Historical analysis indicates that when the gold miners EV/EBITDA ratio falls below 6x, the potential return within a six-month window has been about 21% on average over the past 10 years. Also noteworthy is the current de-rating in the EV/EBITDA ratio is one of the most significant in more than 10 years.

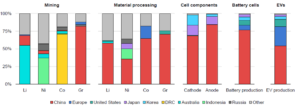

The metal market capitulation was stemmed in a large part by rising geopolitical tensions in the Taiwanese straits. This benefited gold and gold equities but also the critical metals as once again the market focused on China’s dominance in the entire downstream EV battery supply chain (Figure 1).

Figure 1 - Geographical distribution of the global EV battery supply chain

Source: IEA

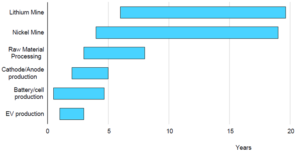

One could argue that the recent US $739bn climate change package (scaled back from $3.5tn) is woefully inadequate to address the global imbalance in green technology, but it is a start. At least the ASMF is thinking ahead as our green metal investments are all ‘non Chinese influence/controlled’. They should be developed into this next 5-10 year window when metal supply will be at its most acute. It is interesting to consider the structural shortfall in metal supply developing, against the relative short duration of any global recession. A recession just kicks the supply can down the road 2-3 yrs. When it takes 5-15 yrs to commission a mine, the problem becomes obvious.

Figure 2 - Range of typical lead times to initial production for EV battery supply chain steps

Source: Benchmark Mineral Intelligence