The UK Market – Outlook for UK companies

By Anna Macdonald

"I spoke to Sean Farrington this morning on the outlook for UK companies and what we’re expecting in the year ahead. There’s a bit of a ‘back to school’ sense to the markets today, with Rishi Sunak and Kier Starmer giving press interviews over the weekend and with investors taking stock of 2022, and thinking forward to 2023. We reflected on the strong performance of FTSE100, which has now reached a four year high. Blue chips eked out a positive performance last year which is much better than the other main global indices (the S&P 500 fell nearly 20% in 2022).

Why is this? Half the market capitalisation of the larger capitalised stocks is made up of five sectors that have been robust, international performers. Oil & Gas was the strongest, as the invasion of Ukraine drove prices up and the sector rose nearly 42%. Mining rose 23%, tobacco just shy of 22%, pharma was up 12% and banks rose nearly 8%.

What about the mid-250 and smaller companies?

The midcap and small cap indices have been much weaker, falling around 20%. Consumer stocks, such as leisure, retail and hospitality, have been hit by falling customer demand and rising energy, food and labour costs. Industrial stocks have also suffered from higher input costs and snarled supply chains. We have also seen a change in the investment environment towards the usually highly valued technology, telco and media names, as rising interest rates put pressure on valuations. We’ve also seen several successive years of outflows from the UK market in general, and particularly profit taking at this ‘end’ of the market. Does this present an opportunity? Many corporates and private equity firms seem to think so, as bids totalling $50m were made for UK-listed names last year. They have been searching, as we as fund managers do, for good quality names with secure and repeatable revenue streams, such as EMIS, Euromoney and Ideagen, all holdings that received bids in 2022.

Relief for energy bills

Jeremy Hunt, the Chancellor, will reveal the new iteration of the package the government are proposing to support firms with high energy costs later today, when the previous one expires at the end of March. Instead of a government supported price of electricity and gas, the support will now be a discount to current prices. This, combined with the rapid fall in energy prices that we have seen over recent months, is forecast to cost the Treasury significantly less. Hopes of tailored packages for different sectors have been dashed as it is fiendishly complicated, however the extremely consumptive areas such as glass, steel and ceramics will have targeted additional support.

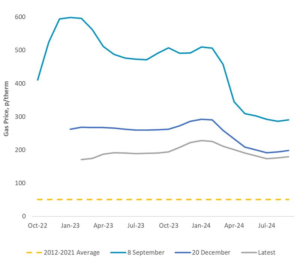

This chart, from Panmure Gordon, shows that the spot and forward prices for wholesale gas have fallen sharply in the last few months. This is a relief but still you can see that the costs are four or five times more than the long run average for 2012-21. It should be remembered that energy prices are volatile, particularly given the febrile situation in Ukraine. The implications for business in the UK is that they will continue to try to use less energy, and cut costs elsewhere in their businesses. Some businesses will inevitably shut up shop. GDP numbers on Friday are likely to show however that we have only just officially entered a recession (two successive quarters of GDP decline). However, businesses can adapt, and those that do, should emerge leaner and stronger, and grow market share, once we start to see a recovery.

Important Information

Issued by Amati Global Investors Limited, which is authorised and regulated by the Financial Conduct Authority. This communication is provided for informational purposes only and does not represent an offer or solicitation to buy or sell any securities; nor does it provide you with all the facts that you need to make an informed decision about the merits or otherwise of investing in any products or services offered by Amati. Please refer to the risk warning below.

Risk warning

Past performance is not a reliable guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount they originally invested. Investments in smaller companies in particular can be higher risk than investment in more established blue-chip companies. Prospective investors should always read the relevant fund or product documentation, which contains full details of the costs and charges as well as specific risk warnings.