UK Market Thoughts

By David Stevenson, Fund Manager, Amati UK Smaller Companies Team

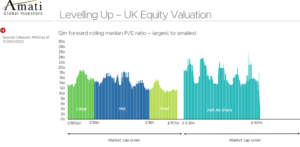

The most notable feature in the UK over the last year has been the elevation of large cap to market leadership. This obviously stems from sector weightings in resources, utilities, and healthcare, each of which have been strong outperformers, but it also speaks to investor risk appetite in an environment of growing threats. The following chart, produced by Liberum, is one that we have tracked for many years, but the current version shows a pattern we have never seen before. More normally, forward PEs are low for large cap, rising sharply for most of midcap, and then falling away through small cap as illiquidity impacts. They then rise sharply for the top end of AIM, before falling away again towards the lower end of the AIM cap scale. Recent relative performance, however, has created an almost flatline profile – mid and small caps have been heavily derated.

Whilst we are seeing signs of slowing earnings momentum in the UK market, it is not yet universal, or even notable in a historic context.

But clearly the market is looking further out (beyond the FY2 forecasts used above) and anticipating greater earnings growth threats to come. At this juncture it is difficult to predict how the eventual geo-political and macro risks will pan out, but the market has chosen not to hang around.

Using a very broad-brush PEG approach, the various segments of the market now sit as follows (using CY23 estimates as there is still lingering pandemic noise in CY22 numbers - source: Liberum, Datastream):

Large - 11.6x for 3.5% growth….3.3 PEG

Mid – 12.4x for 16.9% growth….0.7 PEG

Small – 10.3x for 17.9% growth….0.6 PEG

Whilst there is obviously dubious accuracy in two-year aggregate forecasts, the broad picture is clear – either there is still massive downside risk to mid/small cap (SMID) forecasts relative to large cap, or SMID has been harshly treated. There is obviously the additional impact of derating caused by rising yields, but the UK SMID universe is a broad church, not heavily populated with US-type tech valuations and loss-makers.

Some companies will clearly fare better than many others in the environment to come. A short list of attributes would be companies more exposed to sustainable structural growth in their markets than purely cyclical, or those which have ongoing pricing power evidenced by high margins allowing inflation pass through, or those with defendable market shares or an ability to take market share, or those with IP-led growth prospects, or those able to self-fund organic or acquisitive growth.

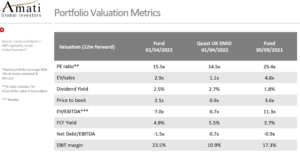

In our own portfolio we have seen the impact of market trends, and the forward valuations for our holdings have corrected a lot. Our focus continues to be quality and growth, evidenced by the available free cashflow, balance sheet strength and high margin metrics shown below. We remain confident about the prospects for our stocks to exhibit ongoing progress based on the attributes mentioned above, but we are obviously cognisant of significant potential headwinds. We have made some changes, but the essential core of our portfolio has not changed and has got a lot cheaper as a consequence of recent SMID weakness.

Important information

This article is a financial promotion issued by Amati Global Investors Limited, which is authorised and regulated by the Financial Conduct Authority. It is provided for informational purposes only and does not represent an offer or solicitation to buy or sell any securities, and nor does it provide you with all the facts that you need to make an informed decision about the merits or otherwise of investing in any Amati funds or products. Please refer to the risk warning below.

Risk Warning

Past performance is not a reliable guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount they originally invested. Investments in smaller companies in particular can be higher risk than investment in more established blue-chip companies. Prospective investors should always read the relevant fund or product documentation, which contains full details of the costs and charges as well as specific risk warnings.

Amati Global Investors Limited

8 Coates Crescent, Edinburgh EH3 7AL

+44 (0)131 503 9115

info@amatiglobal.com

www.amatiglobal.com

Calls are recorded and monitored.

Amati Global Investors is authorised and regulated by the Financial Conduct Authority.