Great things come in small packages

Let’s start with the bad news

As the first half of 2022 draws to a close, we reflect on what has been a dismal period for both bond and equity investors, with the S&P 500 down around 20% so far this year and government bond yields rising rapidly in response to levels of inflation not seen since the 70’s. This asset repricing is driven by a new era of interest rates, with short rates likely to reach 4% in the US and 3% in the UK by the end of 2022. There is a sense that investors are desperate for the trials and tribulations of the first half of 2022 to be over, but the chart below from the recent BofA investor survey suggests to us that extreme pessimism is now a deeply embedded and consensual view amongst global investors.

Source: BofA Global Investment Strategy

Post the invasion of Ukraine we need to consider the likelihood of recession in the US and the UK, with the Bank of England now seeing this as a central case. Even Federal Reserve chair Jay Powell has now acknowledged that a US recession is “certainly a possibility”. The war in Ukraine is not going to disappear magically or quickly. That will keep food and energy prices high and inflationary forces firmly in play regardless of central bank actions. Any slowdown may not be deep or long, but we are now in the next phase of market adjustment – falling corporate profits. Earnings usually shrink by double digits at low points - today analysts still expect them to be positive in 2022 and 2023. So, there is worse news to come with possibly further capitulation. All of this suggests a cautious ongoing approach to investing.

As investors in UK small and midcap businesses we have to acknowledge that the UK is not in a good place. The pound is falling steadily, which in turn may push up domestic inflation and further crimp consumer spending, whilst the cost-of-living crunch is now a reality as consumer confidence hits a 40 year low in May. So, the UK domestic economy could be in for a very rough ride. That’s bad news for UK cyclically exposed stocks as well as the broader UK mid and smallcap indices where domestic sales exposure is typically in the 50-60% range compared to only 30% for large cap.

So, the bear case as predicted by the consensus is straightforward – more interest rate rises, persistently high inflation and falling company earnings leading to further stock market falls.

Lights and Tunnels

The first point to make is that there is a good chance we are midway through a bear market already. A recent study by UBS suggests that bear markets in the US last for around 12 months (we’re at month six) and involve a peak-to-trough average decline of c.11% for ‘shallow’ recessions and 34% for ‘deep’ ones. As with all historical reference points, there’s a variation around the average but barring a deep depression we have already seen a major adjustment in both share prices and investor sentiment.

Markets and real life do not always move in tandem — the COVID crash of 2020 coincided with a massive rally from April of that year onwards, at a time when fear and gloom were at their peak. Few would have predicted the stellar market returns of the following 18 months. The longer-term linkage between GDP growth and stock market returns is a weak one, with starting valuation points typically a far greater factor in impacting future returns than economic growth per se.

It is also worth bearing in mind that the UK market is already out of favour with investors with a heady cocktail of Brexit, Partygate and weak Sterling serving to undermine global investor confidence. The chart below looks at PE ratios for the UK, Europe and the US adjusted for the major sectoral differences in the indices. Even taking this into account UK assets remain modestly priced.

Source: Liberum, Datastream, 31/05/2022

This suggests to us that the current boom in M&A involving UK listed companies looks set to continue with over $70bn of transactions completed in 2021 and almost $30bn either proposed or completed so far in 2022 (Source: Numis). We shall return to this theme and the impact on the Fund later in this paper.

The Smallcap Discount

The past twelve months have been painful ones for investors in UK small and midcap stocks with the mid, small and alternative market indices all seeing major setbacks. By contrast larger companies in the UK have enjoyed their day in the sun, fuelled by a very low weighting to technology and high exposure to resource sectors.

Smaller companies underperformance

Source: Numis 31/05/2022

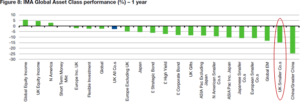

When we translate this to returns from the main IMA fund sectors, we can observe that UK smaller companies have gone from hero to zero at a rapid pace.

Source: Investment Management Association, Lipper

This comes against a background of falling valuations across the smallcap universe in general and a period of relative underperformance against larger cap indices.

We are seeing a number of high-quality smaller companies with strong long-term growth prospects whose share prices and valuations are now significantly lower than their five- year averages. For long-term investors, we believe this disconnect between valuations and growth prospects represents a rare opportunity.

TB Amati UK Smaller Companies – Fund Positioning

At Amati we would summarise our process as investing in high quality businesses with enduring growth potential. As a result, over many years the TB Amati UK Smaller Companies Fund has tended to show a bias towards growth and quality factors, with a correspondingly lower exposure to value measures. The Fund has also tended to be less volatile and have lower beta over the last few years than its main benchmark. The analysis below from Style Analytics highlights the current key tilts in the portfolio compared to our Numis NSCI & AIM benchmark.

Source: Style Analytics, 31/05/2022

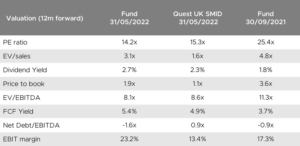

During 2022 we have seen a dramatic change in market leadership away from smallcaps. The subsequent derating of many quality growth companies, combined with the outperformance and therefore higher weighting of lowly rated parts of the market such as the energy sector, has resulted in a major change to the valuation metrics of the portfolio. The chart below covers various current valuation metrics for the Fund and compares it to the readings from last September. We have also included the Quest UK SMID metrics for reference as a proxy for our investment universe.

Portfolio Valuation Metrics

Source: Canaccord Quest / S&P Capital IQ, Amati Global Investors

As highlighted previously the Fund typically has a bias towards growth factors, and therefore we would expect to see slightly higher levels of PE ratio, EV/Sales and Price to Book metrics compared to the SMID universe. However, all of these measures of valuation for the Fund today are significantly below the levels seen nine months ago and in the case of the PE ratio, the Fund now trades on a discount to the Quest universe for the first time in many years

We also take comfort from the higher levels of dividend yield and cashflow that the portfolio now enjoys and would highlight other key quality factors such as the very low levels of debt (net cash) and high profit margins in the portfolio. In our view holding businesses with strong balance sheets and robust profit margins will be a crucial differentiating factor in coping with the forthcoming economic slowdown. We therefore believe that the main challenges in front of us are falls in earnings rather than base valuations.

The measures above reflect some changes in emphasis for the portfolio, with an initial focus on reducing valuation risk through selective stock sales towards the end of 2021. Over the past twelve months we have also increased our holdings in the energy sector, and this has been beneficial in the light of recent events in Ukraine, with a number of our holdings performing very strongly as oil and gas prices have surged. More recently we have taken the opportunity to add to some of our oversold high-quality businesses as well as introducing some new names to the fund.

UK SmallCap – Quality Endures

This focus on quality is worth emphasising again as these factors tend to be less volatile and more durable than the more random and shifting classifications of growth and value. At Amati we view high quality at the portfolio level as a sacrosanct part of our proposition. The chart below looks at the cumulative performance of the highest quintile quality smallcap businesses, as measured by the Quest database over the past twenty years.

Source: Canaccord Quest as at 31/05/2022

M&A – An Important Driver of Returns

Given that we are now in a bear market environment with every chance of an economic downturn ahead, generating positive returns is currently a difficult task. However, we are now seeing an enduring trend towards takeover activity in UK listed companies. As detailed previously, UK companies in aggregate trade on a discount to their European and US peers and this has resulted in over $100bn of completed and pending takeovers during the past eighteen months. The chart below details the businesses held within TB Amati Smaller Companies Fund which have been subject to bids in recent years.

Source: Numis

Whilst it is often difficult to replace such great businesses when they leave, we nonetheless expect more of our portfolio companies to attract takeover interest in the months ahead.

Some Closing Thoughts

It is easy to be gloomy as we sit here today. Rising interest rates, persistently high inflation and falling company earnings leading to further stock market falls all provide a compelling narrative. The specific challenges we face in the UK also suggest that we proceed cautiously from here. However, we believe that this is becoming an increasingly consensual viewpoint and analysis of history suggests that we are already well into the current bear market phase. We have seen a particularly savage de-rating within our universe of UK smaller companies over the past year.

Our message and approach to this is clear - over the long term, exposure to the highest quality businesses is a consistently positive factor in delivering strong performance from UK smaller companies. We are optimistic about the prospects for the TB Amati UK Smaller Companies Fund portfolio. The foundations for positive future returns are built on today’s increasingly attractive valuations, backed by the strong balance sheets and high profit margins we find in most of our holdings. Faced with a highly challenging and ever- changing macro environment we are confident that our ongoing focus on selecting high quality growth companies will deliver strong results for our investors over the medium and long term.

Important Information

This article is a financial promotion issued by Amati Global Investors Limited, which is authorised and regulated by the Financial Conduct Authority. It is provided for informational purposes only and does not represent an offer or solicitation to buy or sell any securities, nor does it provide you with all the facts that you need to make an informed decision about the merits or otherwise of this Fund. Please refer to the risk warning below.

Risk warning

Past performance is not a reliable guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount they originally invested. Investments in smaller companies in particular can be higher risk than investment in more established blue-chip companies. Prospective investors should always read the relevant fund or product documentation, which contains full details of the costs and charges as well as specific risk warnings.

Amati Global Investors Limited

8 Coates Crescent, Edinburgh EH3 7AL

+44 (0)131 503 9115

info@amatiglobal.com

www.amatiglobal.com

Calls are recorded and monitored.

Amati Global Investors is authorised & regulated by the Financial Conduct Authority.