Why invest?

Overview

Portfolio Information

Dividend History

Dividend Reinvestment

DRIS Application Form and Terms & Conditions

Table of returns to 30 June 2024

from shares issued under the Dividend Re-investment Scheme

| Date | Price* | Price gross after tax rebate# | NAV Total Return excluding subscription costs and tax rebate | NAV Total Return including full subscription costs and tax rebate# |

|---|---|---|---|---|

| 12 January 2024 | 93.18p | 65.23p | 5.70% | 51.00% |

| 24 November 2023 | 96.02p | 67.21p | 5.35% | 50.50% |

| 21 July 2023 | 111.11p | 77.78p | -6.56% | 33.48% |

| 25 November 2022 | 140.65p | 98.46p | -23.95% | 8.64% |

| 22 July 2022 | 144.85p | 101.40p | -24.20% | 8.29% |

| 26 November 2021 | 196.03p | 137.22p | -42.25% | -17.50% |

| 23 July 2021 | 208.03p | 145.62p | -44.40% | -20.57% |

| 27 November 2020 | 178.01p | 124.61p | -32.87% | -4.10% |

| 23 July 2020 | 153.60p | 107.52p | -17.87% | 17.32% |

| 22 November 2019 | 148.23p | 103.76p | -15.51% | 20.70% |

| 26 July 2019 | 155.90p | 109.13p | -17.66% | 17.63% |

| 23 November 2018 | 145.72p | 102.00p | -9.61% | 29.12% |

| 27 July 2018 | 177.98p | 124.59p | -24.40% | 8.00% |

| 24 November 2017 | 164.38p | 115.07p | -15.75% | 20.36% |

| 21 July 2017 | 141.35p | 98.95p | -0.03% | 42.82% |

| 25 November 2016 | 115.26p | 80.68p | 26.41% | 80.58% |

| 22 July 2016 | 111.85p | 78.30p | 33.35% | 90.50% |

| 13 November 2015 | 110.73p | 77.51p | 38.97% | 98.52% |

| 24 July 2015 | 107.65p | 75.36p | 46.52% | 109.32% |

| 7 November 2014 | 110.01p | 77.01p | 48.08% | 111.54% |

| 25 July 2014 | 116.88p | 81.82p | 42.79% | 103.99% |

| 25 October 2013 | 121.58p | 85.11p | 41.80% | 102.57% |

| 15 July 2013 | 111.18p | 77.83p | 57.84% | 125.49% |

| 26 October 2012 | 102.36p | 71.65p | 77.93% | 154.18% |

| 17 July 2012 | 103.78p | 72.65p | 79.86% | 156.94% |

*shares allotted under the Dividend Re-investment Scheme are issued without cost

#assumes full recovery of tax relief at applicable rate (all years 30%)

Literature & Reports

Amati AIM VCT Other Documents

Consumer Duty – Adviser Documentation

For older documents, please see our archive:

Amati AIM VCT Annual & Interim Reports

For older documents, please see our archive:

Ratings

The Board

Corporate History

RNS

FAQs

General

Venture Capital Trusts (VCTs) were introduced by the Government in 1995 and were designed to encourage investment in early-stage companies by offering attractive tax benefits in return for the additional risks involved. The legislation has changed over the years, but at present the main tax reliefs available are as follows: income tax relief of 30% on subscriptions for new shares up to a value of £200,000 in each tax year, providing that the investment is held for five years; tax free dividends; and a capital gains exemption on disposal. VCTs are broadly similar to investment trusts and are listed on the Main Market of the London Stock Exchange, with independent Directors whose responsibility is to protect the interests of the shareholders in the VCT.

Valuations for Amati AIM VCT are provided online via the Investor Hub:

Shareholders: To login or register for this service, please go to: https://amati-aim-vct.cityhub.uk.com

For any assistance in registering, please contact the registrar on 01484 240 910 or email: amatiVCT@city.uk.com

Financial Intermediaries: To login or register for this service, please go to: https://amati-aim-vct.cityhub.uk.com

If you require any new clients registered to your firm and/or username, please contact Amati Global Investors on 0131 503 9115 or info@amatiglobal.com

For financial intermediaries with information rights only, please send your valuation request along with a Letter of Authority (LOA) to info@amatiglobal.com

You can view your holding via the City Hub at https://amati-aim-vct.cityhub.uk.com

You will need to create your account if you have not already registered.

The NAV is published on our website and is updated on a weekly basis please see above.

If you would like your IFA to have access to the information on your shareholding, you may invite your IFA to view your holding online by clicking on ‘Invite Intermediary’. You then need to enter your advisor’s email address in the ‘Intermediary Email’ field, click the shareholding(s) you would like them to have access to and then click ‘Send Invitation’. Your advisor will then receive an invitation code which will enable them to access your shareholding information once City has approved the request. You may also review any invitations regarding your financial advisor in the ‘History’ section.

Alternatively, you can complete an IFA Letter of Authority (PDF) and send it to us at The City Partnership (UK) Limited, The Mending Rooms, Park Valley Mills, Meltham Road, Huddersfield, HD4 7BH. You may also send a scanned signed copy to amativct@city.uk.com.

Please stipulate in the Letter of Authority whether or not you would like your IFA to be able to have online access to your shareholding too.

If you need to update the registered address on your shareholding, please login to your Amati Investor Hub account, click on ‘My Shares’ and then click on your name. You then need to scroll down to the Address section and click ‘Change’. You can then complete the relevant fields before clicking ‘Save’.

Alternatively, please complete a Change of Address Form (PDF) and send it to us at The City Partnership (UK) Limited, The Mending Rooms, Park Valley Mills, Meltham Road, Huddersfield, HD4 7BH. You may also send a scanned signed copy to amativct@city.uk.com.

You DO NOT need to send us your share certificate(s).

If you need to update your email address on your shareholding, please login to your Amati Investor Hub account, click on ‘My Shares’ and then click on your name. You then need to scroll down to the Email section and click ‘Change’. You can then complete the relevant field before clicking ‘Save’.

If you would like to update the method you receive communications from City and the company, please login to your Amati Investor Hub account, click on ‘My Shares’ and then click on your name. You then need to click the ‘Summary’ tab and click on your relevant shareholding description. This will take you to a screen where you can see your general shareholding details, as well as details of transactions, share certificates, payments, and dividend elections (if applicable). Please click ‘Details’ and scroll down to the ‘Mail Option’ section and click ‘Change’. In the ‘Update Mail Option’, please choose one of the below options and then click ‘Save’:

Post: you will receive hard copy communications from the company Web: you will receive notification in the post that you may access communications online (though you will continue to receive hard copy proxy forms, where applicable) Email: you will receive email communications from the companyAlternatively, please send a letter of instruction (which includes your full name, address and the company you hold shares in) to us at The City Partnership (UK) Limited, The Mending Rooms, Park Valley Mills, Meltham Road, Huddersfield, HD4 7BH. You may also send a scanned signed copy to amativct@city.uk.com.

If you wish to change your name registered on your holding, please contact us in writing with the following information:

The company in which you hold shares Previous name and registered address Your new name in full Your signature in your new name Send your Share Certificates for endorsement Supporting documentation for your change of name such as: Marriage: Marriage Certificate Divorce: Decree Absolute and Birth Certificate/previous Marriage Certificate Name change for other reasons: Stamped Deed Poll Company name change: Certificate of Incorporation on change of name by the Registrar of CompaniesWe cannot accept a fax or email of this notification, as original signatures are required.

We accept certified or court sealed copies of legal documents to amend the register. Any certified copy of any document should have the original stamp proving certification (photocopies of a certified document will not be accepted).

Please send any documentation to us at The City Partnership (UK) Limited, The Mending Rooms, Park Valley Mills, Meltham Road, Huddersfield, HD4 7BH.

To appoint a Power of Attorney, you must submit a Certified copy of the Power of Attorney, duly certified by the donor, a solicitor or a duly certified notary public, that it is a true and complete copy of the original. Where the Power is more than one page, this certification should appear on each and every page.

The Power of Attorney should be sent to us for registration. Your covering letter should state all the companies in which shares are held and therefore where the Power of Attorney should be registered against.

Please send the Power of Attorney to us at The City Partnership (UK) Limited, Suite 2 Park Valley House, Park Valley Mills, Meltham Road, Huddersfield HD4 7BH.

Amati Global Investors cannot buy back shares directly from our VCT investors. If you wish to sell your shares you will need to do so through a broker, who will sell them via the market maker.

If you do not have an existing relationship with a broker, and would like further guidance on this, please do not hesitate to contact us on 0131 503 9115 or info@amatiglobal.com.

Although procedures will vary, possession of the relevant share certificate will be necessary to sell your shares. We will be happy to assist you in gathering any information you may need in respect of your investment.

To transfer your shares you need to complete a Stock Transfer Form (PDF) and send it to us together with the valid share certificate.

If the transfer is exempt from Stamp Duty or no chargeable consideration is given for the transfer, you need to complete the reverse of the transfer form.

Further information is set out in the Stamp Duty section of the HMRC website which includes a stamp duty calculator.

If stamp duty is applicable, please contact the Stamp Office.

Birmingham Stamp Office

9th Floor

City Centre House

30 Union Street

Birmingham

B2 4AR

The transfer form should be sent to the stamp office before sending it to us with the certificate. Once you receive the stamped transfer form back please send it to us at The City Partnership (UK) Limited, The Mending Rooms, Park Valley Mills, Meltham Road, Huddersfield, HD4 7BH. with the valid share certificate.

We can place a note on the register with a copy of the original or official copy of the Death Certificate. To register the executors on the register we will require either an original UK Grant of Representation or an office copy bearing the impressed seal of the Court. Once this is registered you can transfer or sell the shares.

If you do not choose to obtain a Grant of Representation and the estate does not exceed the Inheritance Tax limit with the total value of the holding not exceeding £20,000 at the date of death, a Small Estates Declaration and Indemnity form can be used to register the death. Please contact us on 01484 240910 if you would like a Small Estates Declaration and Indemnity form.

Please send any documentation to us at The City Partnership (UK) Limited, The Mending Rooms, Park Valley Mills, Meltham Road, Huddersfield, HD4 7BH.

Dividends

Dividends for Amati AIM VCT are paid out annually, with the payments typically falling around July and November. Full details of any upcoming dividends can be viewed in the annual and interim reports, please click here to view the latest report. A full history of dividends paid to date can also be viewed on our website by clicking here.

If you need to update your mandate instructions on your shareholding, please login to your Amati Investor Hub account, click on ‘My Shares’ and then click on your name. You then need to click the ‘Bank Details’ tab and complete the relevant fields before clicking ‘Save’.

Alternatively, please complete a Dividend Mandate Form (PDF) and send it to us at The City Partnership (UK) Limited, The Mending Rooms, Park Valley Mills, Meltham Road, Huddersfield, HD4 7BH. You may also send a scanned signed copy to amativct@city.uk.com

Please return any cheques that are out of date to the registrar. If you would like to have the outstanding dividends reissued into a bank account, please provide the registrar with the relevant account details. Please return these to The City Partnership (UK) Limited, The Mending Rooms, Park Valley Mills, Meltham Road, Huddersfield, HD4 7BH.

If you need to update your Dividend Reinvestment Scheme election on your shareholding (if applicable), please login to your Amati Investor Hub account, click on ‘My Shares’ and then click on your name. You then need to click the ‘Summary’ tab and click on your relevant shareholding description. This will take you to a screen where you can see your general shareholding details, as well as details of transactions, share certificates, payments, and dividend elections (if applicable). Please click ‘Details’ and scroll down to the ‘Election Type’ section and click ‘Change’. Scroll down to the ‘Manage Election’ section, then please check the details are correct and read the terms and conditions. Please then tick the declaration at the bottom and click ‘Submit’.

If you would like to withdraw from the reinvestment scheme, please return to the ‘Election Type’ section and click ‘Change’. Scroll down to the ‘Manage Election’ section and click ‘Withdraw from Scheme’.

If you would like to enrol in the Dividend Reinvestment Scheme, you may also complete a form (a PDF should be downloadable in the ‘Manage Election’ section). You may also either visit the company’s website to download a Dividend Reinvestment Scheme election form or email The City Partnership (UK) at amativct@city.uk.com to request one.

If you would like to be removed from the Dividend Reinvestment Scheme, you can also send a letter of instruction (which includes your full name, address and the company you hold shares in) to us at The City Partnership (UK) Limited, The Mending Rooms, Park Valley Mills, Meltham Road, Huddersfield, HD4 7BH. You may also send a scanned signed copy to amativct@city.uk.com

Share Certificates

You do not need to split your certificate. A balance certificate will be issued to you for any shares that remain after the sale. However, if you wish to split your certificates into two or more certificates, send a letter to our registrar detailing how you want your certificates to be split. The registrar will require an original signature together with the relevant share certificate(s). Please send the instruction to: The City Partnership (UK) Limited, The Mending Rooms, Park Valley Mills, Meltham Road, Huddersfield, HD4 7BH.

Share certificates are typically issued around 10 working days following the allotment date and will be issued to the investor directly.

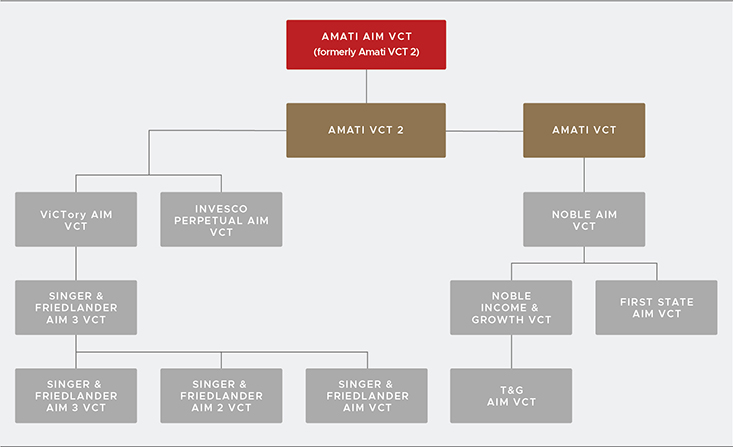

The only valid share certificates are under Amati AIM VCT and Amati VCT 2. If you hold any share certificates under the following names, these have now been replaced and can now be destroyed if you so wish:

First State AIM VCT Noble AIM VCT Noble Income & Growth VCT Singer & Friedlander AIM VCT Invesco Perpetual AIM VCT Amati VCTIf you are not in possession of your share certificate we require you to complete a letter of indemnity to obtain a new one.

Please send us a letter confirming you require an indemnity and we shall send one to you for completion. There may be an administration fee for issuing a new certificate. Please send the letter of request to The City Partnership (UK) Limited, The Mending Rooms, Park Valley Mills, Meltham Road, Huddersfield, HD4 7BH. You may also send a scanned signed copy to amativct@city.uk.com

Tax Relief

The summary above is for illustrative purposes only and any potential tax benefits to investors will vary according to individual circumstances. Income tax relief can only be claimed against income tax due to be paid in the same tax year as the share subscription. Prospective investors are strongly advised to seek independent advice as to their tax position and as to the suitability of any VCT investment before proceeding. For detailed information provided by HMRC on VCT tax reliefs please click here.

After you purchase your shares, you will be issued with a tax certificate which is typically issued at the same time as your share certficate. If you pay tax under PAYE you can either contact HMRC and have your tax code adjusted immediately or you can claim your income tax relief through your Self-Assessment form at the end of the tax year.

Yes, income tax relief can be claimed on shares issued as a result of re-invested dividends.

Offer (if open)

The Amati AIM VCT Offer is now closed. To be kept informed of future offers, please contact us on 0131 503 9115 or by email: info@amatiglobal.com

We can facilitate initial advisory fees on an advisory basis only. Fees for initial advise can be facilitated through the application process. Ongoing fees are only applicable on execution only off platform basis, and will be paid by the Manager. Ongoing fees of 0.375% are paid on an annual basis and are limited to 5 years.

Regulatory

VCT funds receive special tax benefits because of their role in supporting the UK economy, but they must meet a number of conditions, many of which are similar to those for Investment Trusts. The main test unique to VCTs is that within three years of raising funds, and at all times thereafter, a VCT must ensure that 70% of its investments (by value recorded at cost, or last price paid per share) are ‘qualifying holdings’, that is shares or securities in companies which meet the conditions of the VCT scheme.

The rules governing qualifying holdings are complex and have been subject to many changes over the years. Funds raised through share issues during different periods are be subject to slightly different rules governing qualifying holdings. In this context it is worth noting that older VCTs, including the Amati AIM VCT, may benefit from being able to maintain pools of money which were raised under older sets of rules, and which allow them to continue to make new qualifying investments under those older rules, where it is advantageous to do so.

The main conditions that companies must meet in order to issue shares that form part of a VCT’s qualifying holdings are as follows:

The investee company must be unquoted, which for the purposes of the legislation includes companies whose shares are traded on the Alternative Investment Market (AIM). It must be carrying out a qualifying trade, which for the purposes of the legislation excludes the following: dealing in land; financial activities; leasing assets; farming or forestry; hotels; shipbuilding; producing coal and steel; generating electricity. Its gross assets must not exceed £15m prior to the investment, and £16m afterwards. It must be independent. It must control all its subsidiary companies, and own more than 50% of each of them. At least 10% of each qualifying holding must be in ordinary shares of the investee company, and at least 70% of qualifying holdings in aggregate must be in ordinary shares. The investee company must also satisfy all of the conditions set out below as well.For more detailed information provided by the HMRC on the conditions for VCT qualifying holdings please click here.

As from April 2014 VCTs may lose their tax-advantaged status if they invest in new shares in a company which has raised more than £5m from state aided sources over the twelve months prior to and including the date of investment. During the summer budget of July 2015 new conditions were announced, which became effective from Royal Assent in November 2015, with the stated intention of ensuring that state aided funding becomes more targeted as well as fully compliant with EU rules. These conditions in effect impose stricter limits on the nature and extent of investments which may be made by VCTs, and can be broadly summarised as follows:

In addition to the existing annual investment limit of £5m, no investment may be made by a VCT in a company that causes that company to receive more than £12m (£20m if the company is deemed to be a Knowledge Intensive Company) of state aid investment (including from VCTs) over the company’s lifetime. A subsequent acquisition by the investee company of another company that has previously received State Aid Risk Finance can cause the lifetime limit to be exceeded. No investment may be made by a VCT in a company whose first commercial sale was more than 7 years prior to the date of investment, except where previous State Aid Risk Finance was received by the company within 7 years (10 years in each case for a Knowledge Intensive Company) OR where both a turnover test is satisfied and the company is entering a new market or commercialising a new product. No funds received from an investment into a company can be used to acquire another existing business or trade.Two important exemptions have been introduced into the legislation to allow VCTs to manage their liquidity effectively through certain types of non-qualifying investments. Investments in UCITS funds and in shares purchased on a Regulated Market (for example the Main Market of the London Stock Exchange) are both exempt from the new restrictions placed on investments made by VCTs. This means that the Amati AIM VCT can broadly maintains its strategy of investing in the TB Amati UK Smaller Companies Fund (which is a UCITS fund), and of investing in certain individual stocks listed on the Main Market of the London Stock Exchange. Non-qualifying investments in AIM traded shares will, however, be subject to all of the new restrictions, as AIM is not, for the purposes of the legislation, a Regulated Market.

Please note that what we have provided above is not an exhaustive summary and should not be relied upon when considering an investment in Amati AIM VCT. For further details please refer to the policy paper published by HMRC, which can be found here.

In early 2016 HMRC is expected to provide more detailed guidance on the application of the new rules, at which time we will update this area of the website with any information of relevance to the Amati AIM VCT.